Gross earnings calculator

Calculate PF contribution paid by employer ie 12 of the basic wage. Help Please enter the amount of Total Gross Pay and Corrected Total Gross Pay for each pay period below to.

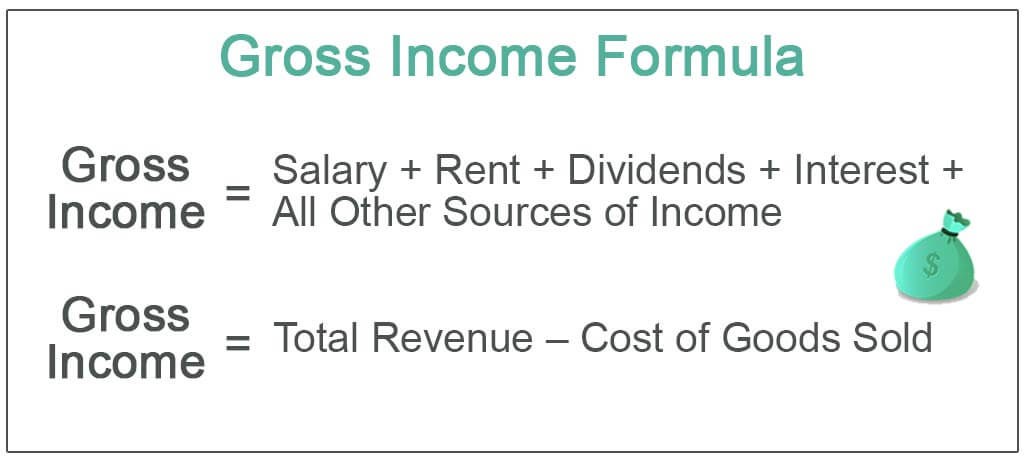

Gross Income Formula Step By Step Calculations

Net profit is the companys earnings after removing all cost of goods sold COGS overheads marketing expenses and even taxes.

. Net earnings X 9235 the amount subject to self-employment tax. The calculator allows you to compare how different sample taxpayers fare under different proposals. Gross earnings - business expenses net earnings.

The take-home salary calculator for Poland. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. There are some restrictions on specific AGI deductions to note when using our gross income calculator.

It also displays all parts of salary. Important Note on Calculator. You can also input a custom scenario.

You will need a copy of all garnishments issued for each employee. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Was erroneously separated due to an unjustified or unwarranted personnel action and did the employee have outside earnings during that.

Calculate your gross profit margins here with Simplicitys margin calculator. This calculator provides calculations of NAE on gross weekly earnings up to the weekly amount corresponding to the 2022 maximum annual insurable earnings ceiling of 106500. You can also save for retirement while reducing your taxable income.

Polish salary 1 yearly - see what is happening with your salary month by month the calculator supports both an employment contract a specific task contract and a job order contract Polish earnings 2 taxno tax - simple conversion between gross and net. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. Your actual weekly benefit amount will be confirmed once your claim has been approved.

Using the gross profit margin formula we get. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Here are the variables the calculator will figure out for you.

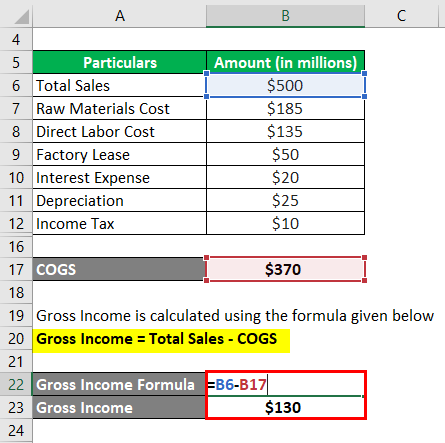

Here total sales are equal to total revenue of a company. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. All in One Financial Analyst Bundle 250 Courses 40 Projects 250 Online Courses.

The net to gross calculator helps you see how much an amount will worth be after we add or before we deduct a tax look below for an explanation it can be a bit tricky. Getting the Most Out of the Ridester Earnings Calculator. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Modified adjusted gross income MAGI Definition. Calculate the basic wage from the CTC 40-50 of CTC Gross Salary Calculation. Revenue vs Earnings Key Difference.

Take Home Salary Calculation from CTC Step by Step Process. The gross income of a specific company means the value of the difference between the total realized income and the cost of sold products or services. Depending on the state or tax benefits for which you are applying the types of assessment of earned earnings are also different.

Use the Disability Insurance DI and Paid Family Leave PFL Calculator to get an idea of what your Disability Insurance or Paid Family Leave benefits might be. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Recruitment Relocation Retention Incentives.

Gratuity paid by the employer is basic wage2615 Step 4. Is 30 for the year. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Now the gross salary of the employee is CTC PF. Revenue for year 2018 100907 Revenue for year 2017 73585 Revenue Formula Example 3. It takes your gross income and calculates all your take-home netto earnings month by month.

And these figures in fact resonate with our personal experience and. Help with gross earnings Go to next link for details Required Field Federal income tax withheld Dollars and cents for example 100025. If you want to learn more about taxes and other levies paid in Poland check out our other calculators.

Calculate the Social Security portion of self-employment tax. For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments. Calculate the amount that equals 9235 of your net earnings which is the amount subject to self-employment tax.

Weve created a tax calculator that helps demonstrate how the Tax Cuts and Jobs Act TCJA and other major tax reform proposals could affect taxpayers in different scenarios. Gross Margin Gross Profit Revenue 100. Gross Paycheck --Taxes-- --Details.

Gross Profit Net Sales Cost of Goods Sold 400000 280000 120000. However they seem to agree that the most likely range of driver earnings is around 1518 per hour nationwide in gross earnings before expenses. Our paycheck calculator will help you determine how much more you should withhold.

2021 Net Average Earnings Calculator XLS WSIB determines the Net Average Earnings NAE that takes into account the probable income tax payable by a worker on his or her. Back Pay Calculator Toggle submenu. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of.

It is mainly intended for residents of the US. Polish national insurance ZUS income taxes and other costs of working as an employee in Poland. Therefore we cannot accept any.

MAGI calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax benefits and government-subsidized health programs and whether you can make tax-deductible contributions to an individual retirement account or contribute to a Roth IRAEssentially your MAGI is a modification of your AGI. Generally a gross profit margins calculator would rephrase this equation and simply divide the total gross profit dollar amount mentioned above by the net sales. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

Gross Profit Margin Formula Table of Contents. School tuition and fees are capped at 2500 with 100 percent of the first 2000 and then 25 percent of the next 2000 eligible as a deduction. You can consider it as the money you can.

From the above calculation for the gross margin we can say that the gross margin of Honey Chocolate Ltd. And is based on the tax brackets of 2021 and 2022. Qualified educator expense deductions are capped at 250.

Its not advisable to rely only on results of this margin calculator for computation of employee earnings employers tax liabilities and margin comparisons. Enter your rates into the fields to get an immediate calculation. This calculator provides estimates only.

We will then calculate the gross pay amount required to achieve your net paycheck.

Agi Calculator Adjusted Gross Income Calculator

4 Ways To Calculate Annual Salary Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

How To Calculate Gross Pay Youtube

Sales Tax Calculator

How To Calculate Gross Income Per Month

Gross Income Formula Calculator Examples With Excel Template

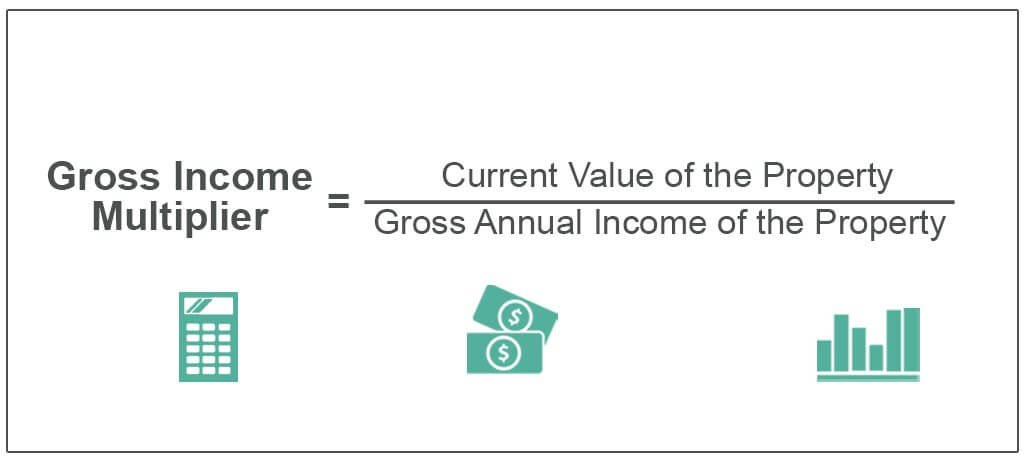

Gross Income Multiplier How To Calculate Gross Income Multiplier

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Income Formula Calculator Examples With Excel Template

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Income Formula Step By Step Calculations

Gross Income Formula Calculator Examples With Excel Template

Net To Gross Calculator

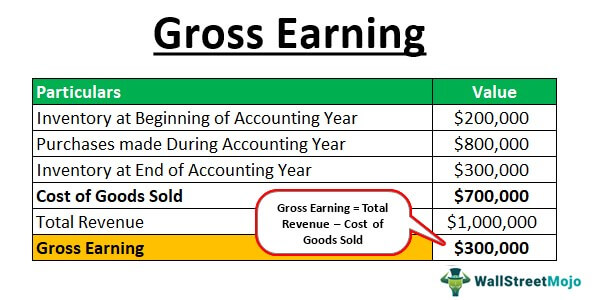

Gross Earning Meaning How To Calculate Gross Earning